CASHFLOW

A Personal Financial Advisor App

Background

An R&D project | Cashflow is a personalized financial companion.

Using user's data on their income, spending, lifestyle, and goals, it will allow them to get a better overview of their finances and find out the areas they need to pay attention to. It will also provide a set of best actions to reach their financial goals.

In this project I took part in research, cooperation with financial advisers, user testing and product design.

The Research

The company embarked on a large-scale market research on people's financial state in Ireland.

Research Divided The Population Into 4 Groups

1. Having trouble managing the day-to-day

2. Doing fine now but not ready to handle an unexpectedly high expense or change

3. Comfortable today but missing substantial assets for the future

4. With strong financial foundations

User Landscape:

According to the research in 2019-2020, about 70% of people in Ireland fall into the groups that need to have better savings, assets, and financial planning to not only thrive today but handle unexpected turns of events in life.

The challenge

To take the complexity out of financial data and deliver a tailor-made and appropriate experience for these target groups. Many users find financial information intimidating. We also needed to have the right tone of voice throughout the app for these profiles.

We needed to Turn complicated information into an easy-to-understand and engaging experience.

The Ambiguity

Even though the AI-generated financial recommendations were of good quality and designed with the help of experienced financial advisors, we didn't know for sure how the app would be perceived by the users.

How would people receive the financial overview assessments and forecasts about their lives or the decisions we'd recommend they should take? How would they react to the forecasts? The things we'd tell them they need to change. Might they get optimistic, or sad? Anxious or excited? Interested or offended?

The Goal

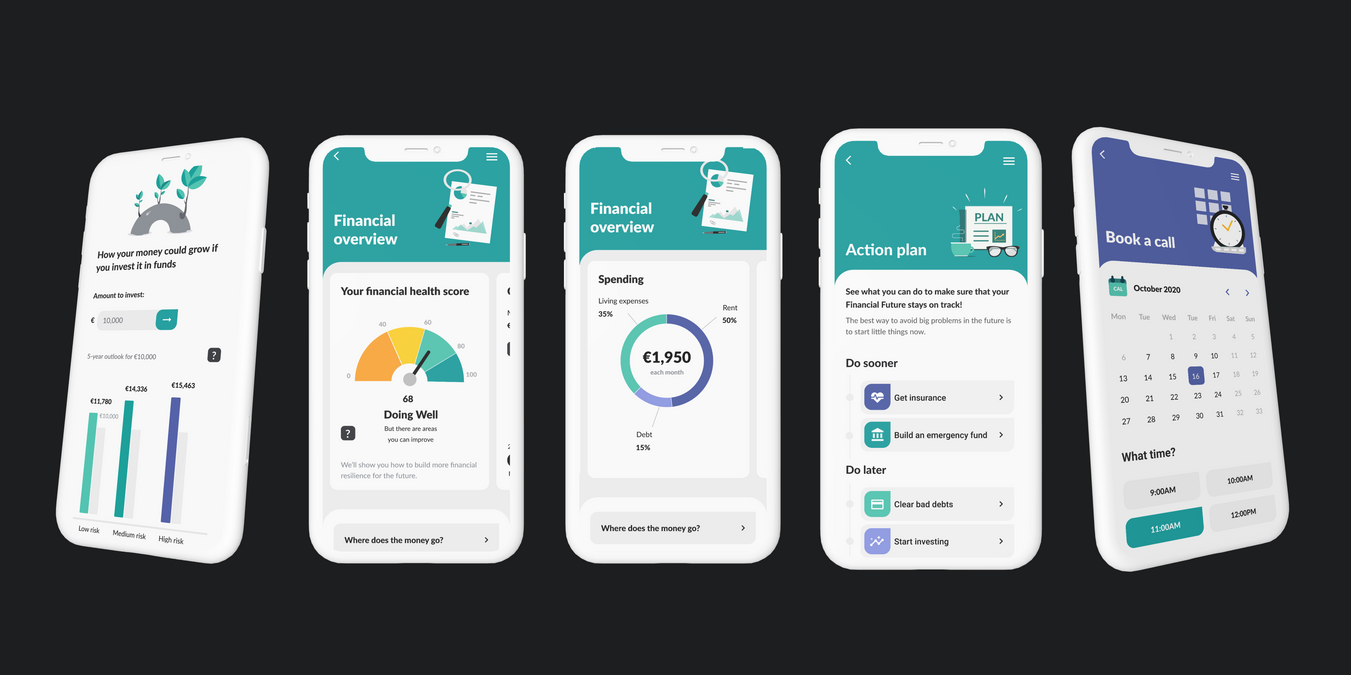

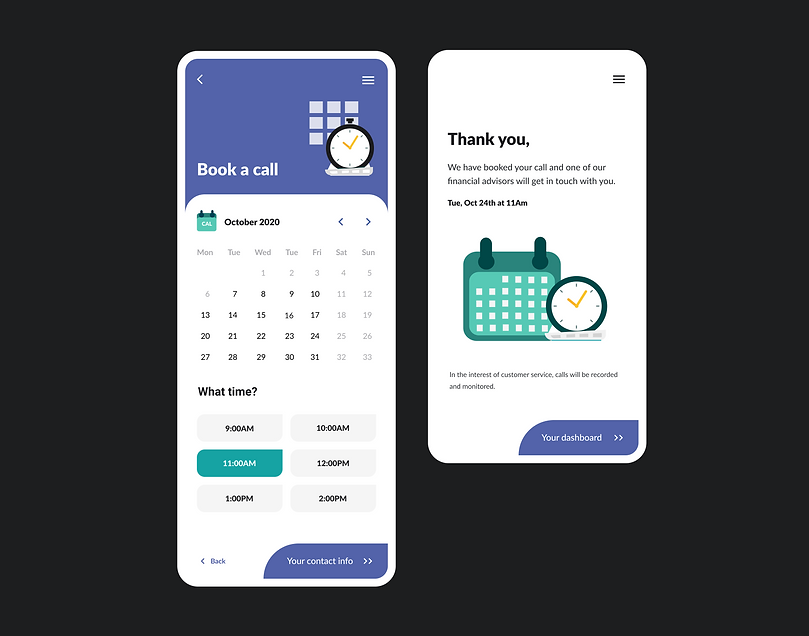

We wanted to create an app that would start by asking users questions about their financial state, habits, lifestyles, and goals to give them an overview, a financial score, important next steps, best actions, and advice. It could also connect them to a human financial advisor.

1

Vision:

To develop a user-friendly app that serves as a personal finance assistant, catering to a broad audience, from those who wish to transition from paycheck-to-paycheck living and people who are comfortable today but need more strategic financial management.

2

Significance:

The app focuses on empowering users with tools to gain a comprehensive overview of their finances, identify improvement areas, and establish achievable goals.

By simplifying the process of financial planning and management, the app encourages users to explore their current financial landscape and spending, different future scenarios, save, invest, and ultimately reach their financial aspirations.

3

Expected Impact:

Aimed at fostering financial literacy and independence, the app guides users through setting realistic goals and selecting the best strategies to achieve them, making personal finance more accessible and manageable.

User testing

A series of moderated user testing was conducted with 50 users. These users were recruited for each of the first 3 of the 4 major target groups. We used a special formula while interviewing the test candidates to determine what group they'd fall into before the tests.

Each target group would see their own version of the app tailored to their financial state.

Learning And Feedback:

The designs went through iterations based on the growing understanding of how people feel, think, and act on their economy. And how this information can be presented to them in an impactful way without causing. Even hard truths should be communicated in a sobering way without causing unnecessary anxiety.

Based on this we needed to make a few changes in the design, specifically what we chose to display and how we do it.

The Result

Using information and data visualization, a chose-your-own adventure style, and a light gamification style, the app transformed complex personal finance data into intuitive and dynamic views. It helped users understand their financial landscape, explore future scenarios, and plan for near and long-term future by setting goals and knowing what the best next actions are.

#

During the survey after user testing, 44 of 50 users agreed that the app has changed the way they think about their finances.

Impact

Customer Engagement | Increased Revenue & Operational Efficiency

User feedback from tests and interviews indicated significant engagement and satisfaction with the new concept.

A notable number of users expressed interest in booking time with a financial advisor—a key metric the organization aimed to enhance.

Financial advisors benefited from having access to customers' financial profiles through the app, allowing them to bypass time-consuming introductory sessions. This streamlined process enabled advisors to focus on more in-depth consultations.

Designs